how to report coinbase on taxes

Automatically connect Coinbase Binance and all other exchanges wallets. Persons to trade unregistered.

Does Coinbase Report To The Irs Zenledger

For security reasons were unable to update your legal name on your behalf.

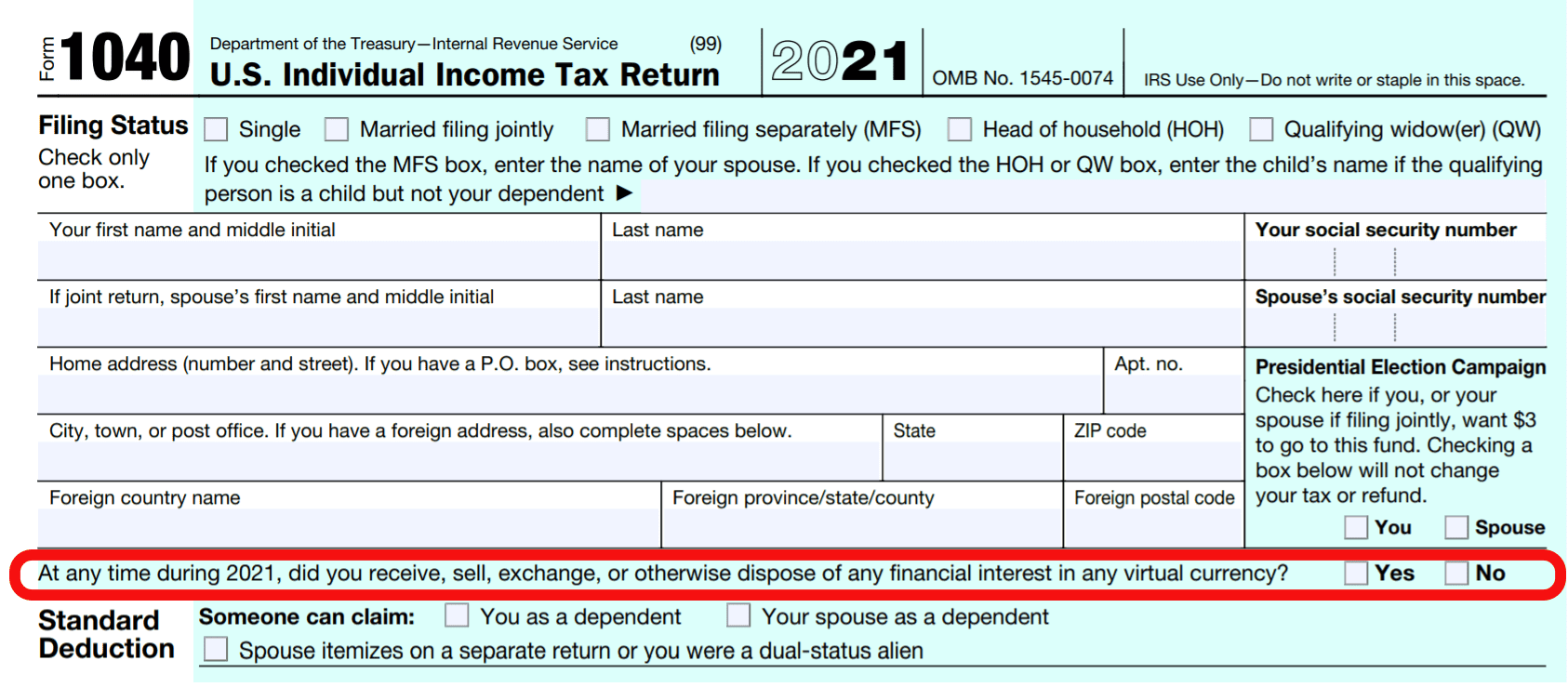

. Individual investors should report NFT income via IRS Form 1040 US. Decentraland is 8740 below the all time high of 590. Crypto can be taxed in two ways.

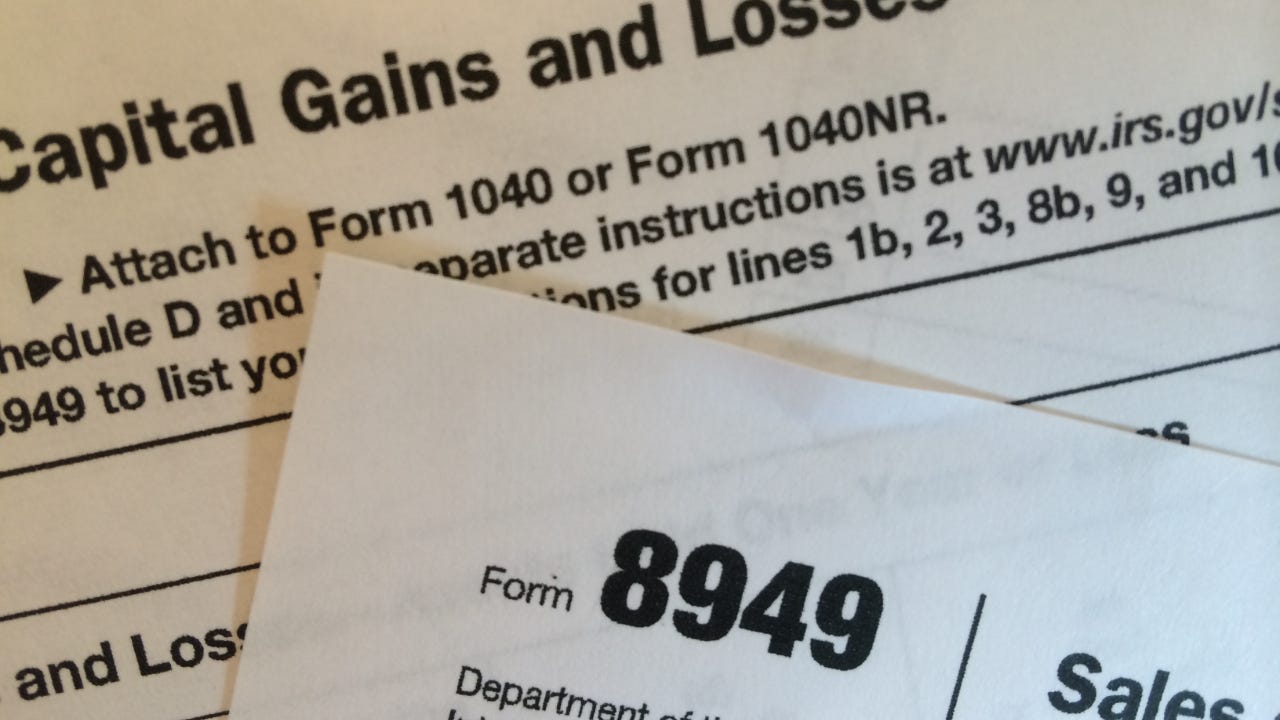

The contest starts on June 22 2022 at 1200 pm. Individual Income Tax Return along with IRS Form 8949 Sales and other Dispositions of Capital Assets and IRS Schedule D Capital Gains and Losses. This report is designed to help taxpayers quickly and easily understand their gains or losses for the tax year using our.

Keep updated on the latest events that are effecting markets the economy and your portfolio. Started to do taxes this weekend and seriously big kudos to CoinTracker for an amazing job on their product - hugely relieved to have my crypto taxes done in less than 5 mins. The Coinbase Wallet Avalanche Emojis Story Contest is a contest available to eligible Coinbase users see eligibility requirements below.

Coinbase Wallet Avalanche Emojis Story Contest. Coinbase Earnings History. Coinbase Global Inc.

9 it announced net revenue for the three-month period of 803 million which was down 61 from the year-ago period. Either as income a federal tax on the money you earned or as a capital gain a federal tax on the profits you made from selling certain assets. POWW POWWP AMMO or the Company the owner.

After youve done this follow the steps to report your Coinbase Card as loststolen and well send you a new one at no cost. Coinbase is a secure online platform for buying selling transferring and storing digital currency. Here are the midday movers for Aug.

Coinbase posted dramatic growth in earnings per share in the past two fiscal yearsEPS grew from 025 in Q1 FY 2020 to as high as 647 in Q2 FY 2021. The most common reason people need to report crypto on their taxes is that theyve sold some assets at a gain or loss similar to buying and selling stocks so if you buy one bitcoin for 10000 and sell it for 50000 you face 40000 of taxable capital gains. Presently Coinbase Card can fit a name of up to 20 characters on the physical card.

CBO projects future federal revenues under current law estimates the distribution of income and federal taxes and analyzes the effects of various features of the federal tax system and potential changes to that system. Stocks wobbled on Thursday as investors awaited Fridays jobs report for July. 04 2022 GLOBE NEWSWIRE -- AMMO Inc.

Conference call to be held on same day at 500 PM Eastern Time SCOTTSDALE Ariz Aug. Theres a long list of crypto activities youll need to report to the IRS. Were working to expand this in the future.

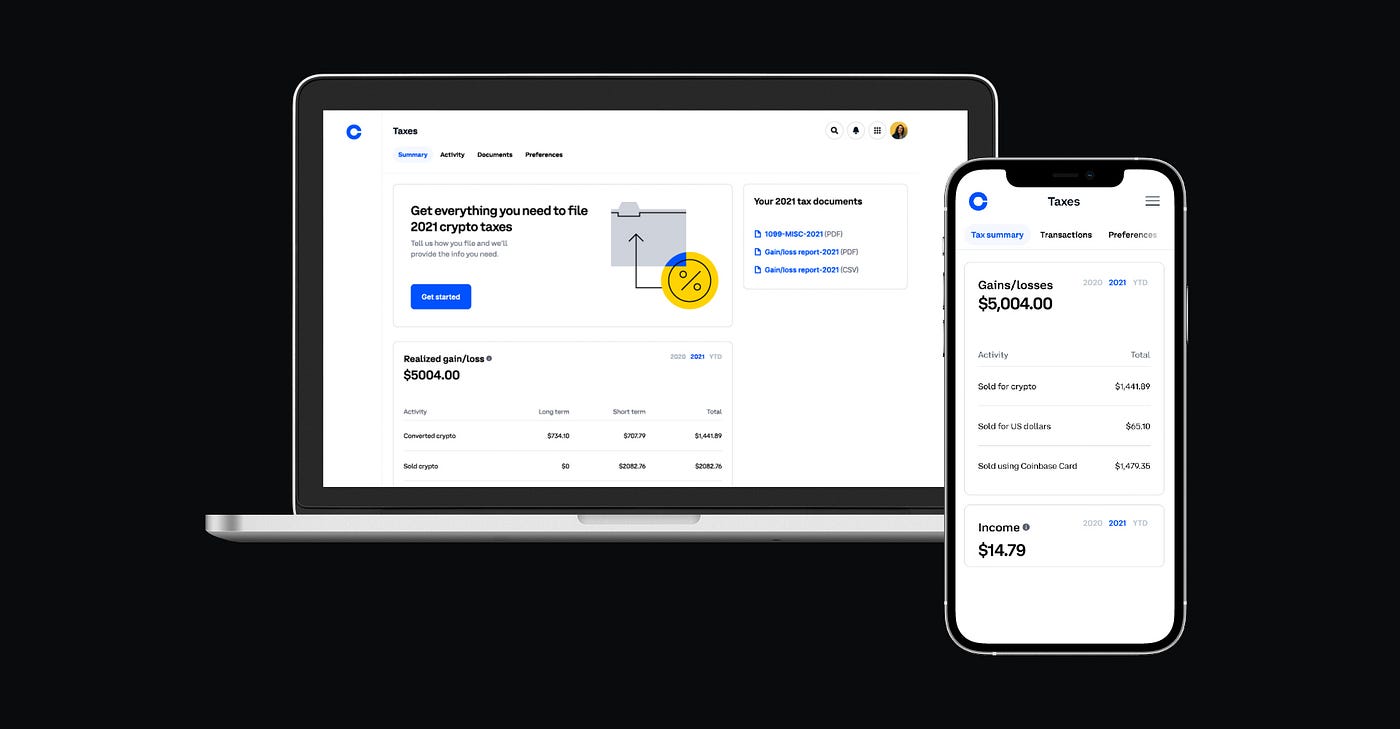

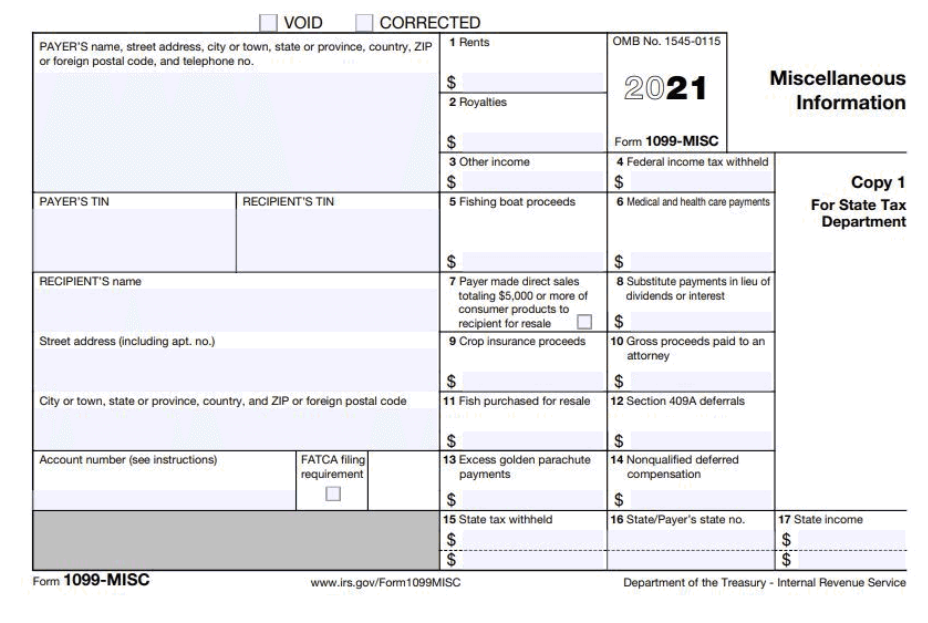

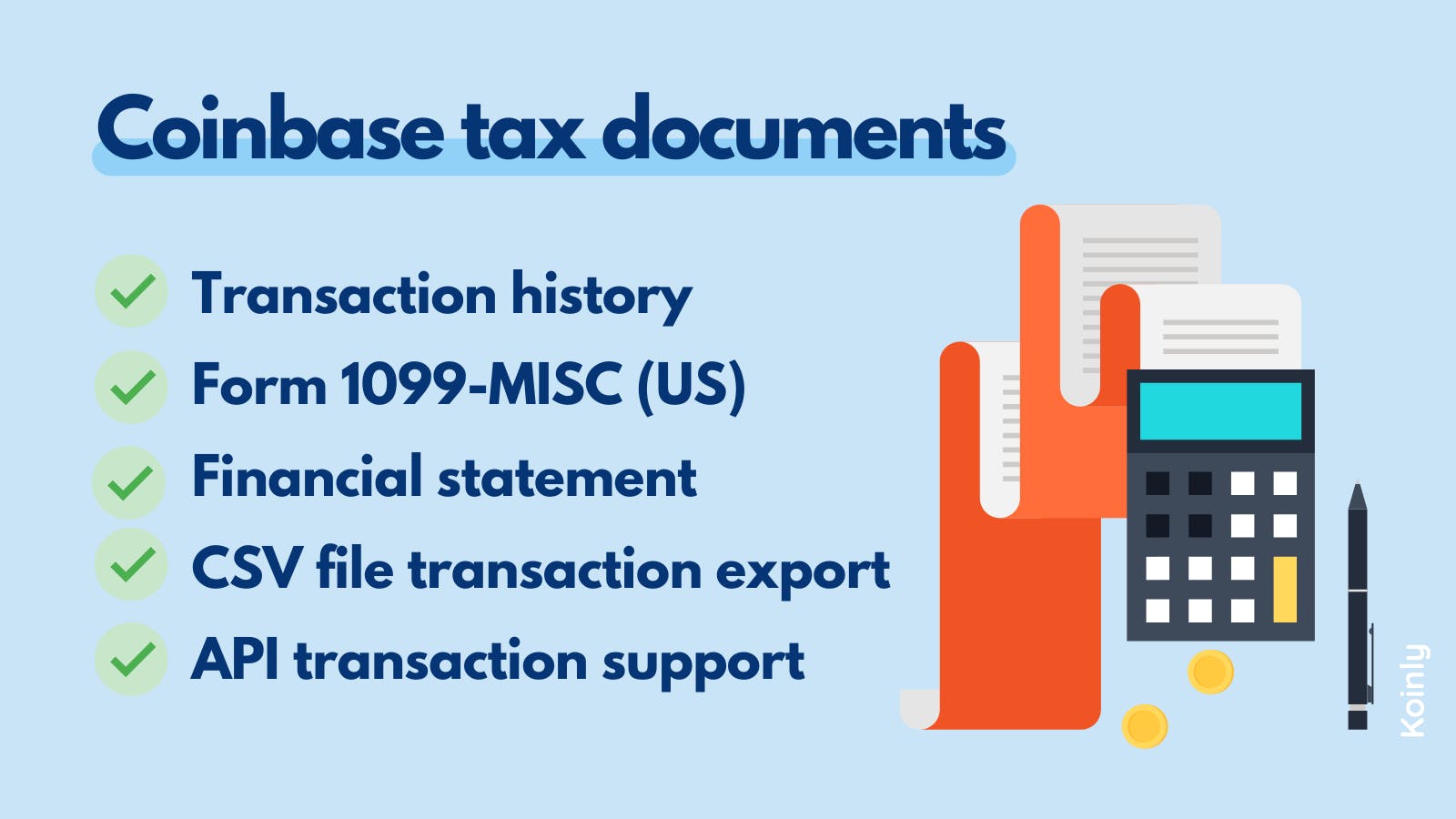

Securities and Exchange Commission SEC is reportedly probing crypto exchange Coinbase a publicly-traded company it oversees on suspicion it allowed US. You can export your tax report to file with any CPA tax filing service eg. Coinbase will not provide a Form 1099-K or 1099-B for the 2021 Tax Season for trades on Coinbase.

Several companies including Tesla Inc Netflix Inc and Coinbase Global Inc have also been cutting jobs and slowing hiring as global economic growth slows due to higher interest rates inflation. Remote-First-CompanyBROOKLYN NY August 09 2022--Coinbase Releases Second Quarter 2022 Shareholder Letter. The current circulating supply is 1852410797279 MANA.

Discover new cryptocurrencies to add to your portfolio. When required by the IRS the crypto exchange or broker you use including Coinbase has to report certain types of activity directly to the IRS using specific forms and provide you with a. COIN reported mixed results in its Q2 FY 2022 report.

You can find your history of IRS forms in the Documents section of your Coinbase Tax Center including a digital copy of your 1099-MISC for 2021 if you received one youll also be mailed a paper copy in February unless you opt to go. When Coinbase Global COIN-649 reported its second-quarter earnings on Aug. Earnings per share EPS missed analyst estimates.

Coinbase Global Inc NASDAQCOIN shares jumped nearly. Federal revenues come largely from individual income taxes and payroll taxes with corporate income taxes and other taxes playing smaller roles. Creators who create NFTs as part of their profession or business should report NFT income based on their.

August 29 2022 - The current price of Decentraland is 074365 per MANA USD. Bitcoin transactions are verified by network nodes through cryptography and recorded in a public distributed ledger called a blockchainThe cryptocurrency was invented in 2008 by an unknown person or group of people using the name Satoshi Nakamoto. This tax season Coinbase customers will be able to generate a GainLoss Report that details capital gains or losses using a HIFO highest in first out cost basis specification strategy.

Coinbase reported losses per share of -498 significantly wider. Bitcoin is a decentralized digital currency that can be transferred on the peer-to-peer bitcoin network. The IRS gets copies of all the 1099s and W-2s you receive so be sure you report all required income on your return.

IRS computers are pretty good at cross-checking the forms with the income shown. ARK sold about 14 million shares of Coinbase valued at roughly 75 million based on Tuesdays closing price across three of its exchange-traded funds according to a daily transaction report.

The 2020 Guide To Cryptocurrency Taxes Cryptotrader Tax Tax Guide Best Crypto Tax Software

Coinbase Pro Tax Documents In 1 Minute 2022 Youtube

Tax Forms Explained A Guide To U S Tax Forms And Crypto Reports Coinbase

How The Irs Knows You Owe Crypto Taxes Tax Refund Irs Get Cash Now

How Do Crypto Taxes Work In The Us Learn What Forms You Ll Need And How Crypto Might Affect Your Taxes Tax Guide Bitcoin Capital Assets

Does Coinbase Provide Tax Forms Understanding Coinbase Taxes Zenledger

The Complete Coinbase Tax Reporting Guide Koinly

The Complete Coinbase Tax Reporting Guide Koinly

Top 7 Best Crypto Tax Software Companies

Crypto And U S Income Taxes When And How Is Crypto Taxed As Income Coinbase

Coinbase 1099 Guide To Coinbase Tax Documents Gordon Law Group

How To Answer The Virtual Currency Question On Your Tax Return

Koinly Free Crypto Tax Software Tax Software Filing Taxes Cryptocurrency Trading

Coinbase Is Now Your Personalized Guide To Crypto Taxes By Coinbase The Coinbase Blog

Coinbase 1099 What To Do With Your Coinbase Tax Documents Lexology

The Complete Coinbase Tax Reporting Guide Koinly

Did You Trade Crypto In 2018 If So You May Owe Taxes If You Re A Us Taxpayer Here Are Steps You May Have To Take What Forms You Ll Tax Guide

Need To Report Cryptocurrency On Your Taxes Here S How To Use Form 8949 To Do It Bankrate